In economics, American Economist Irving Fisher defined monopoly as a market with the “absence of competition,” creating a situation where a specific person or enterprise is the only supplier of a particular thing, such as people and capital. Fisher is a neoclassical economist, and various concepts named after him include the Fisher equation, the Fisher hypothesis, the international Fisher effect, the Fisher separation theorem, and the Fisher market.

To understand the prevailing monopoly across various industries in Canada, first, we need to understand the geographical location of Canada. Canada is the second largest country in the world, and it has three ocean borders: the Pacific Ocean to the West, the Atlantic Ocean to the East, and the Arctic Ocean to the North. What’s on South? The United States of America.

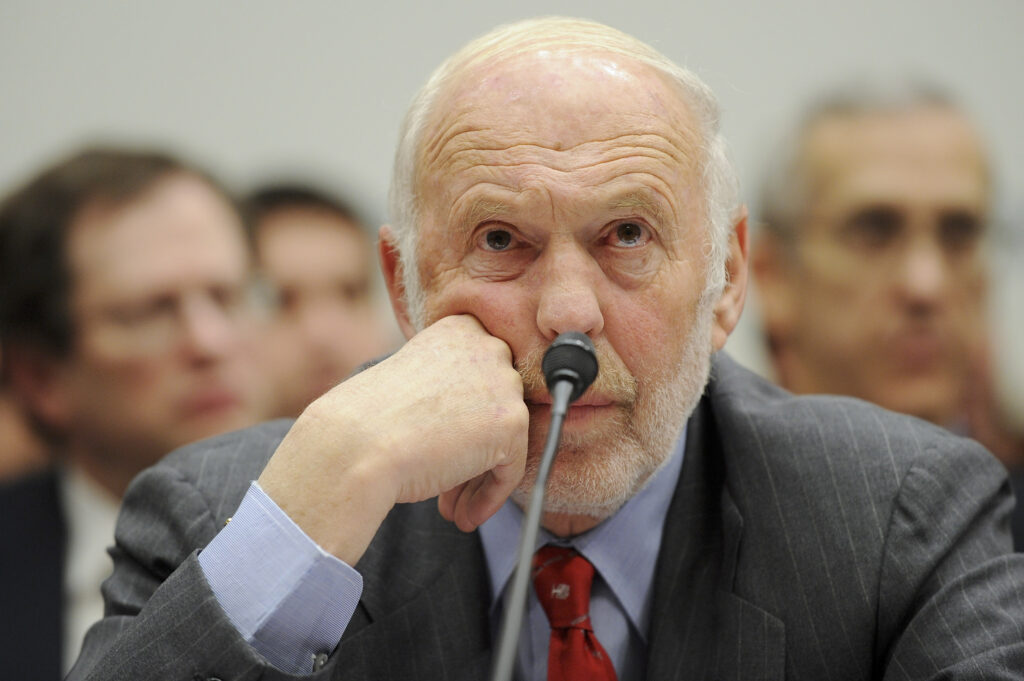

Seven years ago, Nobel Prize-winning Economist Joseph Eugene Stiglitz outlined in the article ‘The New Era of Monopoly is Here’ published in The Guardian that monopolies exist in today’s economy due to the combination of various factors such as increased market concentration, technological changes, barriers to entry, and political influence.

According to Stiglitz, the top 10 banks’ deposit market share surged from about 20% to 50% in just 30 years (from 1980 to 2010), clearly showing the market concentration in some industries. Likewise, in companies like Microsoft, there are barriers to entry, due to which no other company tries to compete, creating a type of monopoly.

In today’s world, the probability that a company can control the entire global market is close to 0. A probability close to 0 means the event is ‘not likely’ to occur. This is due to various reasons, such as changing market dynamics, globalization, and regulatory constraints.

There was a time when John D. Rockefeller used to control the entire oil industry. He is also known as ‘The Architect of America’s First Monopoly.’ But in today’s world, monopolies do not operate, capturing the entire market. However, these monopolies are called legal monopolies because they have the majority of market share in a single industry, such as banking or transportation.

The 1890 Sherman Antitrust Act was created to break up unfair monopolies in the United States. It broke up monopolies in the USA, such as John D. Rockefeller’s Standard Oil. But legal monopolies exist even today. The Fédération Internationale de Football Association (FIFA) is one of the examples of Legal Monopoly.

In the article ‘America’s Monopoly Problem: Why It Matters and What We Can Do About It’ by Stacy Mitchell and Susan R. Holmberg, the authors explained the prevailing problem of monopoly across various sectors in the United States. As per the article, four big banks control more than 41 percent of the assets of the entire U.S. banking system, two telecom corporations dominate Internet access, and three corporations make up three-quarters of the beer Americans consume.

Out of the many reasons behind the monopoly in Canada, one could be due to the monopoly in America. The geographer from the University of Chicago named Edward Ullman coined the Spatial Interaction Theory. Spatial interaction theory explains how behavior, such as firms operating in monopolistic markets, can extend beyond political borders and influence economic outcomes in nearby regions.

Spatial interaction is the general term for any movement of people, goods, or information over space that results from a decision-making process. Geographer Ullman proposed three principles of spatial interaction: complementarity, transferability, and intervening opportunity.

Complimentary is creating demand for exchange. For example, Canada has abundant oil and minerals, and the USA has a solid manufacturing base and large consumer market. Transferability is the ease of moving goods, people, and information. The Canada–United States border is the longest international border, at 8,891 km or 5,525 miles long. Intervening opportunities refers to a more attractive option that comes up while you’re on your way to another destination.

So, how does a spatial interaction theory prove that the monopoly in Canada is due to the monopoly in the United States? Let us consider Pluto (created name) in the United States as the new competitor in the Smartphone industry, bypassing giants such as Apple and Samsung. Due to this, consumers in Canada will eventually demand Pluto’s smartphone in place of others. This will ultimately leverage its established monopoly by capturing a significant market share in the Northern part of the United States.

Does monopoly exist in Canada?

There is a probability of close to 1 for a monopoly of the United States becoming a primary reason for a monopoly in Canada. A probability close to 1 means the event is ‘highly likely’ to occur.

Gross Domestic Product or GDP is the monetary measure of the market value of all the final goods and services produced in a specific period by a country or countries. After the Bretton Woods Conference 1944, GDP became a primary tool for measuring a country’s economy.

The five primary industries that contribute to Canadian GDP are

- Real Estate, Rental, and Leasing,

- Manufacturing,

- Mining, Quarrying, and Oil and Gas Extraction,

- Finance and Insurance,

- Construction,

- Healthcare and Social Assistance.

Now, look closely at some of the top companies in these sectors.

Manufacturing is the sector that produces goods with the help of labor, machinery, tools, and equipment. Out of 21 manufacturing subsectors, petroleum and coal products, transportation equipment, food, fabricated metal products, and chemical manufacturing subsectors contribute the most.

Now, let’s closely look at the oil and gas industry. As per one of the reports published by Investopedia, the total TT revenue generated by the top ten companies in the sector is CA$ 360.89 Billion. Out of the top five, 79.08% belongs to the top five: Cenovus Energy Inc., Suncor Energy Inc., Imperial Oil Ltd., Enbridge Inc., and Canadian Natural Resources Ltd. Out of these top five company’s revenue, 25.01% belongs to Cenovus Energy Inc. It means Cenovus Energy Inc. controls the most significant part of the oil industry.

Now, let’s look at the banking sector as well. As of 2023, the largest bank in Canada in terms of market capitalization is Royal Bank of Canada, with a market cap of CAD 1.7 trillion, followed by Toronto-Dominion Bank of CAD$ 1.5 Trillion, and Bank of Nova Scotia (Scotia Bank) of CAD 1.2 Trillion.

RBC Bank, the largest bank in Canada, has 11.76% more assets than the second largest bank, TD Bank, 55.12% more than the fifth bank, CIBC, and 96.65% more than the ninth bank, ATB Financial Edmonton of Canada. When we go through the numbers of all 35 banks, the difference percent diverges, which means that, like the United States, very few banks dominate the banking sector.

We can conclude that, like in the United States, legal monopolies exist across various industries in Canada. One could be spatial interaction with the United States for many reasons.

References:

The new era of monopoly is here | Joseph Stiglitz | The Guardian

Rockefeller: The Architect of America’s First Monopoly – wealthfinity

Legal Monopoly: What it is, How it Works (investopedia.com)

Spatial Interaction – An Overview | ScienceDirect Topics

Canada–United States border – Wikipedia

Gross domestic product – Wikipedia

The Economy of Canada: An Explainer (investopedia.com)

The Daily — Annual Survey of Manufacturing Industries, 2022 (statcan.gc.ca)

10 Biggest Canadian Oil & Gas Companies (investopedia.com)

Top 10 banks in Canada: List of Banks 2024 (geeksforgeeks.org)